Forward thinking pays off during COVID

By 2019, remote working had made its way to the top of Pepper Money’s technology priorities. The company rolled out Microsoft 365 and Teams, which ultimately delivered huge pay-offs when COVID-19 lockdowns came less than a year later. While other financial services companies were struggling to play catch up, Pepper Money’s progressive approach allowed teams to transition to remote work quickly and seamlessly.

“Our people in Australia and overseas were able to switch immediately, and we had CBS support right there to help us scale rapidly,” recalls Jeremy. “This was critical, as we immediately experienced a 60% increase in the number of customer calls due to concerns about the impact of COVID.

“Not only were we able to operate, but the systems we had in place meant we could continue to grow. For example, during COVID we realised a strategic opportunity to enable everyone within the Pepper business to work remotely. This included auto-scaling virtual desktop infrastructure and configuring Always-on VPN to all corporate laptops.

Fortunately, we were able to stand this up within just a few weeks – in large part because of our relationship with Canon Business Services.”

Microsoft Teams usage increased exponentially after work from home regulations were enforced.

With VPN in place staff no longer needed to use VDI

The ticket to the game

Another key aspect of the duo’s close relationship over the past decade is information security. In a heavily regulated sector, ripe with financial and non-financial risks, securing the privacy of Pepper’s customer information and keeping on top of threats and opportunities is an essential part of daily operations.

“Canon Business Services has played a crucial role in ensuring we can continue to stand in front of customers, brokers and investors and demonstrate that we take security, risk and compliance very seriously.

“In our industry, security is more than an expectation – it’s the ticket to the game.”

Moving forward with confidence

Now in 2021, CBS is proud of the journey we have taken with Pepper Money these past 10 years.

With only 14% of financial services companies actually starting to implement their digital strategies now, Pepper Money is well ahead of the game.

Supported by Canon Business Services, we continue to work together on keeping Pepper Money at the cutting edge of technology, so they can deliver the superior customer experience they have become renowned for. This is particularly vital in recent times when Fintech companies are causing disruption in the lending sector.

“Pepper Money have invested in the right tech at the right time the whole way,” says Allan. “Their goal is to be agile and bring products and services to market swiftly to provide that next level of customer experience. And we’ve been honoured to walk with them on that journey.”

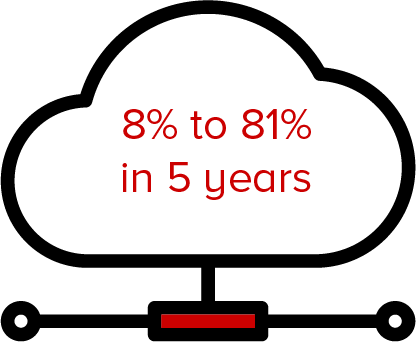

Moving forward, Jeremy says investments in cloud technology will continue to be a key element in their ongoing relationship with CBS.

“We’re already at a high percentage of cloud utilisation, but we want to get this even higher. Automation is another priority journey for Pepper; we’ve built a lot of efficiencies into our environment and want to continue that momentum with the unprecedented new capabilities in AI and machine learning. They not only make the business more efficient, but help drive a better customer experience.

“Our customers rely on us to buy their dream car or dream home…and we want to do all we can to offer them the best possible experience. That’s really what the CBS and Pepper Money relationship has been about this past decade – reducing customer effort by being exactly where they need us to be.”

This is a sentiment we certainly share at CBS. In building long-term relationships with clients such as Pepper Money, we are able to support them every step of the way as they seek to implement the latest technologies to remain competitive and drive continual improvement in performance, efficiency, productivity, and customer experience.

Learn more about our relationship with Pepper Money.